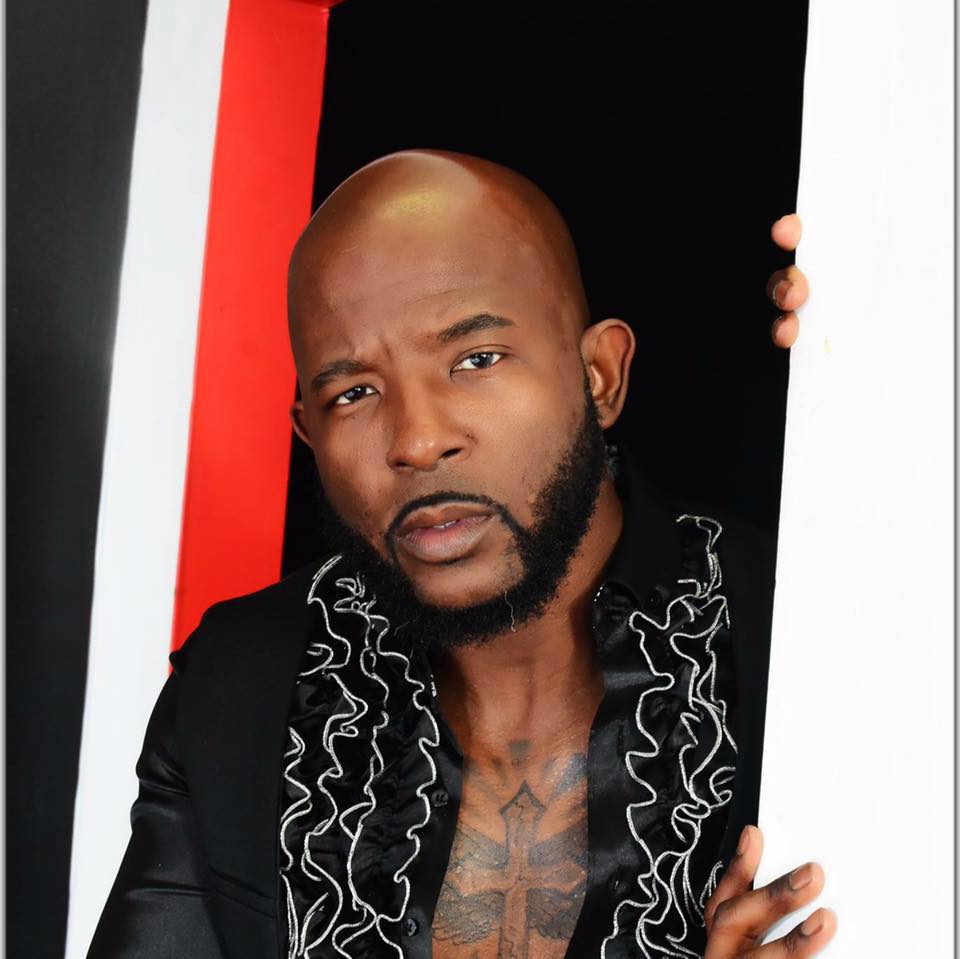

“Bills will continue to roll and this has definitely taken a toll on my business,” says Keith Turks, owner, Hair Kingdom Beauty & Barber Salon at 1492 Madison Ave.

Turks’ remarks reflect dwindling clients, not only at his salon, but throughout the beauty industry and numerous other minority-owned businesses due to coronavirus, the fast-spreading, deadly pandemic disease.

Salons, restaurants, medical offices, building contractors and services that generally depend on foot traffic at brick-and-mortar sites are hurting.

Stay-at-home orders to slow disease spread is necessary, but makes customers (and profits) drop.

“This is our last day (open) until April 7 and we’re praying we can come back then,” says Turks.

“Mayor (Jim) Strickland made a good decision with the stay-at- home order. We’re cooperating.”

Turks, who has been in business seven years, hasn’t had to lay off any staff like some of his counterparts. He’s hopeful about the pending federal economic stimulus and says, “We sanitize work stations, and hand-wash regularly like people should do anyway.”

Jason and Joyce Kyles, owners of Kyles Connections, provide digital and web services to small businesses and non-profits.

Jason and Joyce Kyles, owners of Kyles Connections, provide digital and web services to small businesses and non-profits.

They’re helping clients switch from office to home computing.

Work-from-home operations have proliferated in response to coronavirus (COVID-19). That’s easy for the Kyles, who already work from home, but technologically taxing for those who don’t or never have.

Some minority- and women-owned business enterprises (MWBEs) still don’t take advantage of digital opportunities to connect with clients, according to the consultants.

They see this period as “an opportunity to adopt call technology, online ordering and just make better use of tech- nology.”

The duo says Facebook, Google, LogMeIn (a tool for gaining remote access) and apps using register receipts that ensure repeat clients are a few technologies to embrace.

“Technology is the way of the future and has been for some time, says Joyce Kyles, who also owns a nonprofit now challenged by canceled or postponed events (as recommended by the Centers for Disease Control & Prevention).

“We have to move past fears of technology, not just to survive, but to thrive.”

She says MWBEs already have the tools to be successful (cell phones, laptops, soft- ware, etc.).

“I record more video and use Facebook Live, Adobe Connect, Zoom and other digital platforms to connect with people.”

Rod Branch, a general practice dentist at 2154 Frayser Blvd., says, “Currently, my patients are mainly adults with emergencies and I’m seeing fewer children (since schools shut down”.”

Dr. Branch, who has been in practice 32 years, plans to remain open during normal business hours, but says his colleagues in New York (a coronavirus “hot spot”) have shut down.

As a rule, Branch and his staff use masks, plastic face shields, disposable gloves and sanitizer to prevent disease.

Everett Burton, owner of QuickBooksMadetoOrder, says his home-based business is stable as he “educates small businesses on the need to have options for accessing financial data.”

Burton, whose clients are small to medium-sized businesses, says some MWBEs still have inadequate ways of tracking finances and need better accounting tools, especially if planning to apply for grants or small business loans in COVID-19’s aftermath.

“Coronavirus ‘forces’ businesses to have a tool like QuickBooks.”

Brinson Tax Service, with offices in Whitehaven and Midtown, has steady clients despite COVID-19 for good reason.

“People need their money,” says Sheri Neely, Brinson Tax Service spokesperson and owner of The Neely Agency marketing firm.

“Clients are ‘social distancing’ (engaging six feet apart) and tax preparers are continuously sanitizing works stations … some wear masks.”

(The Trump administration encourages citizens to file taxes for anticipated refunds.)

Neely says as Memphians keep their distance and self-quarantine, “We’re telling them they can fax, email or use a mail slot in the door to submit tax documents.”

“We don’t see a drop in (tax) clients.”

Neely’s marketing firm, however, is suffering due to cancelled events.

“My business has come to a halt.”

“This is traumatic,” says Marc Yates, the new president of the Black Business Association of Memphis (BBA).

“When calling for help, some MWBEs aren’t even sure of what to ask,” he says.

“We’re here to help determine the right questions. This is making us more proactive.” Kyles Connections is building a new website for the BBA and helping with Customer Relationship Management – an approach to engaging with current and potential clients using data analysis.

“Even through financial and pandemic challenges, we must find new opportunities,” Yates says.

A BBA conference planned for June has been postponed until fall 2020 due to COVID-19.

According to Yates, there’s a silver lining to the delay.

“For us, virtual technology is providing better enhancement, branding and exposure.

NOTE: Late Wednesday (March 25), the Senate passed an unparalleled $2.2 trillion economic rescue package steering aid to businesses, workers and health care systems engulfed by the coronavirus pandemic. For stimulus-package details, see the Small Business Administration link below.

LINKS TO HELP FOR LOCAL MWBES

• Black Business Association of Memphis https://www.bbamemphis.com/

• City of Memphis Office of Business Diversity & Compliance https://www.memphistn.gov/business/doing_business_with_the_city/business_diversity_and_compliance (For fast help, email: bdcinfo@memphistn.gov)

• Community Foundation of Greater Memphis

https://www.cfgm.org/give-now/covid-19-regional- response-fund/

• Epicenter Memphis

https://www.epicentermemphis.org/

• Greater Memphis Chamber https://join.memphischamber.com/coronavirus-businessresources

• Mid-South Minority Business Council Continuum http://mmbc-memphis.org/

• Shelby County Government https://shelbycountytn.gov/320/LOSB-and-MWBE-Programs

• Small Business Administration (COVID-19 Relief) https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

https://www.sba.gov/disaster-assistance/coronavirus-covid-19