The City of Memphis has created a pair of micro-loan programs to assist local businesses negatively impacted by the COVID-19 pandemic.

The loans are intended to serve a wide-range of businesses by providing funding relief for rent, payroll and expenses.

“The impacts of COVID-19 have been felt by everyone, but our small businesses have been hit the hardest by this pandemic,” Mayor Jim Strickland said Monday, during the COVID-19 Joint Task Force press briefing.

“We know business owners firsthand whose life savings are in a business that is teetering right now. So, if we can fill that gap to allow them to pay bills and make payroll, that’s what we are trying to do.”

In March, the U.S. Small Business Administration (SBA) announced it would offer low-interest federal disaster loans for working capital to Tennessee small businesses that have suffered substantial economic injury as a result of the coronavirus pandemic. Some business owners have since been denied assistance.

According to the SBA’s website, eligibility for the Economic Injury Disaster Loans is based on the business’ financial impact related to COVID-19. The interest rate is 3.75 percent for small businesses and 2.75 percent for private nonprofit organizations.

“In general, the federal government has so much more money than we do on a local level to support businesses, and I have no doubt that they will be able to support many of our local businesses,” Strickland said. “But these micro-loans are just to fill the gap of those businesses who have been turned down by the SBA program.”

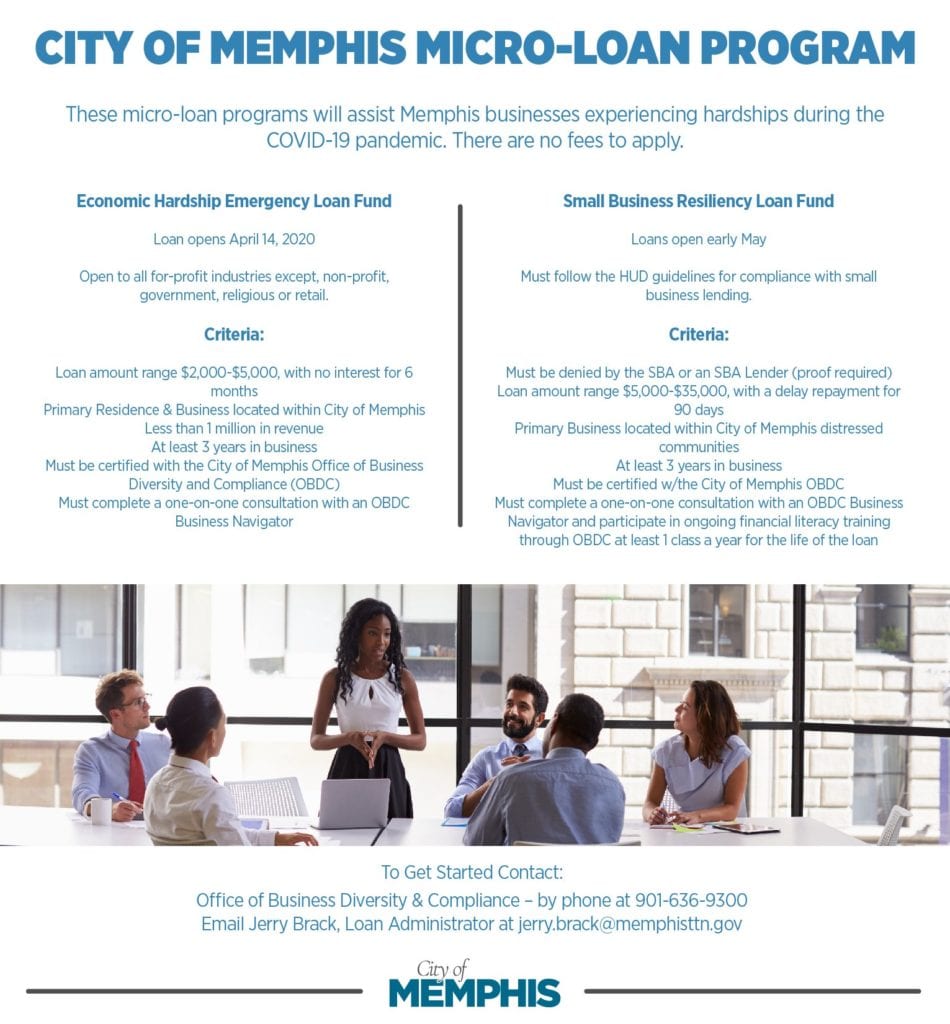

The first micro-loan is the Small Business Resiliency (SBR) Fund. It is a collaboration between the city’s Office of Business Diversity Compliance and the Division of Housing and Community Development. The fund will offer loans between $5,000 to $35,000, with repayment delayed for 90 days.

To qualify, the business must have been previously denied an SBA loan, be located in a distressed community in the city, and must have been in business for at least three years. Certification with the city’s Office of Business Diversity and Compliance is required.

The second micro-loan, the Economic Hardship Emergency (EHE), will offer loans of $2,000 to $5,000, with no interest for six months. To qualify, businesses and owners must be within Memphis, with less than $1 million in annual revenue and must have been in business for at least three years. Certification with the city’s Office of Business Diversity is also required.

Strickland also announced a joint city-county program. The Neighborhood Emergency Economic Development (NEED) is run by EDGE and subject to the board’s approval. The program offers loans between $5,000 and $10,000 to businesses that remain open, with at least a 25% reduction in revenue, and a plan to stay open for 90 days; and $5,000 for businesses that are temporarily closed due to the impact of COVID-19, but have a plan to reopen within 90 days.

Strickland also announced a joint city-county program. The Neighborhood Emergency Economic Development (NEED) is run by EDGE and subject to the board’s approval. The program offers loans between $5,000 and $10,000 to businesses that remain open, with at least a 25% reduction in revenue, and a plan to stay open for 90 days; and $5,000 for businesses that are temporarily closed due to the impact of COVID-19, but have a plan to reopen within 90 days.

To qualify, businesses must also be located in the New Market Tax Credit Zones and have revenue of less than $1 million.

“With all these new programs we are hoping to help our local businesses bridge the gap as we try to get through this,” Strickland said.

Applications for the city’s Economic Hardship Emergency Loan Fund open April 14. The Small Business Resiliency Loan fund will begin accepting applications in early May. Business owners should visit the Office of Diversity and Compliance’s website to apply.